tax shield formula canada

Present value of Total Tax Shield from CCA for a New Asset Notation for above formula. Products and services to Canadian customers in Canadian dollars are substantially affected by the exchange rate with the US.

What Is Gross Up Tax Gross Up Formula Definition Caprelo

It contains the total present value of the tax shield provided by the amortization of the asset less the discounted loss of the tax shield from the eventual disposal of the asset.

. Assets can continue to generate CCA tax shields over an infinite time frame. Building value 75000 total purchase price 90000 total expenses 5000 part of the expenses that can be added to the cost of the building 416667. 553710925401225 1496516 PV lost tax shield.

Interest rates for taxable benefits. This is equivalent to the 800000 interest expense multiplied by 35. Equipment will last forever under the half-year rule.

While tax shields are used for tax savings for both personal and business tax returns this article focuses on tax shields for businesses. This reduces the tax it needs to pay by 280000. Tax Shield Formula Canada.

Thus if the tax rate is 21 and the business has 1000 of interest expense the tax shield value of the interest expense is 210. The formula and variables are as follows. Based on the information do the calculation of the tax shield enjoyed by the company.

Tax Shield 10000 40 100 Tax Shield 4000. The tax shield is a refundable tax credit that offsets a decrease in certain tax credits caused by an increase in your work income. The formula for calculating the present value of the CCA tax shield treats the tax shield as a declining perpetuity.

How to Calculate a Tax Shield Amount. For more information about the tax shield see the following. Tax Rate and Tax Shield.

Federal income tax rates. The value of a tax shield is calculated as the amount of the taxable expense multiplied by the tax rate. Multiply your tax rate by the deductible expense to calculate the size of your tax shield.

The last time the Canadian dollar was at parity with the US. Tax Shield Value of Tax-Deductible Expense x Tax Rate. 5000025401225106112 1278958 PV continuing tax shield on 5537109.

Calculating the tax shield can be simplified by using this formula. E at E bt x 1-T TS E bt x T. 0 1 r d IdT CCA on shield tax PV c.

C net initial investment T corporate tax rate k discount rate or time value of money d maximum rate of capital cost allowance 2. Where dts is the depreciation tax shield atr is the applicable tax rate dd is the total depreciation being deducted. End-user prices of US.

I Total Capital Investment d CCA tax rate Tc Corporate Tax Rate r discount rate S n Salvage value in year n n number of periods in the project n c n r r d dT S r r 1 1 1 5. The following is the Sum of Tax-deductible Expenses Therefore the calculation of Tax Shield is as follows Tax Shield Formula 10000 18000 2000 40. When the above-mentioned formula doesnt meet the condition Then EBIT adj plays a vital.

We have a positive sign in front of it since this is cash inflow. Tax Rate 40Tax Shield Sum of Tax Deductible Expenses Tax rate. PV of CCA Tax Shield Formula Where.

PV of Tax Shield will be added to the cash flow in time period 0 as a positive cash flow. This gives you 750 in depreciation for the first six months of ownership. Tax Shield defines the additional expense on the bottom line is reduced.

CPA Canada s Reference Schedule of allowances and tax rates used in their Core evaluations Keywords Reference schedule. The remaining 83333 of the total expenses relates to the purchase of the land. TABLE III A FORMULA FOR CALCULATING THE PRESENT VALUE OF REDUCTIONS IN TAX PAYABLE DUE TO CAPITAL COST ALLOWAICE.

As such the shield is 8000000 x 10 x 35 280000. Sum of Tax Deductible Expenses 10000. For example suppose you can depreciate the 30000 backhoe by 1500 a year for 20 years.

PV perpetual tax shield on 50000. Do the calculation of Tax Shield enjoyed by the company. Capital cost allowance rates.

Dollar was in February 2013. 5 The fifth item is the PV of all the future tax shields from CCA assuming the. At certain condition tax expense E at becomes E bt x 1-T.

The tax credit for childcare expenses the work premium and the adapted work premium are the tax credits affected by an increase in income. A tax shield is a reduction in taxable income by taking allowable deductions. The intuition here is that the company has an 800000 reduction in taxable income since the interest expense is deductible.

500001 1251 258 55371091 259 853746 X 853746 10000 146254. To do this he has to use the following formula. Thus if the tax rate is 21 and the business has 1000 of interest expense the tax shield value of the interest expense is 210.

Present value PV tax shield formula. Question 33 2 points Which of the following is not true about Capital Cost Allowance CCA in Canada. Stated another way its the deliberate use of taxable expenses to offset taxable income.

PRESENT VALUE OF TAX SHIELD FOR AMORTIZABLE ASSETS Present value of total tax shield from CCA for a new asset acquired after November 20 2018 𝐶𝑑𝑇 𝑑𝑘 115𝑘 1𝑘 Notation for above formula. Therefore the capital cost of the building is. Investment Cost Marginal Rate of Income tax Rate of Capital Cost Allowance xl ry Rate of Return Alffilfftq x 1 Rate of Return MAXIMIJM CAPITAL COST ALLOWANCE RATES FOR SELECTED CLASSES.

The tax shield formula is simple. SELECTED PRESCRIBED AUTOMOBILE AMOUNTS 2017 2018 Maximum depreciable cost - Class 101 30000 sales tax 30000 sales tax. Dollar and the Canadian dollar.

Discusses pricing formula and other fees value-added tax VAT etc. C net initial investment T corporate tax rate k discount rate or time value of money d maximum rate of capital cost allowance 2. Depreciation tax shield 30 x 50000 15000.

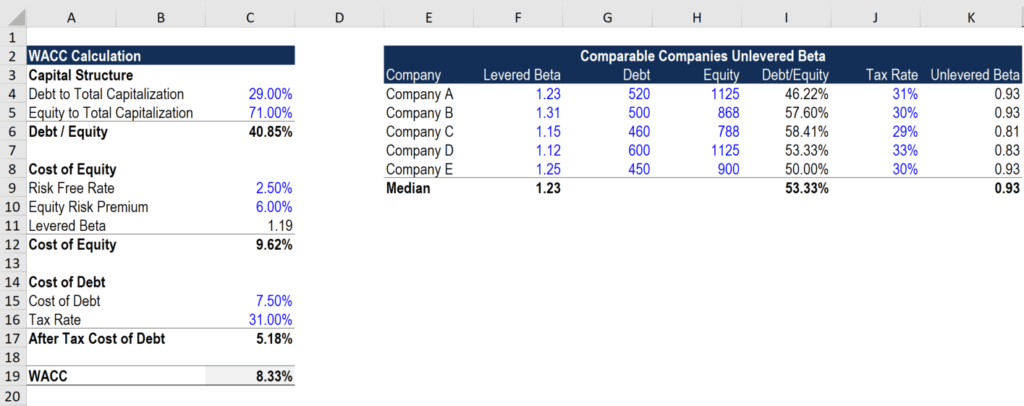

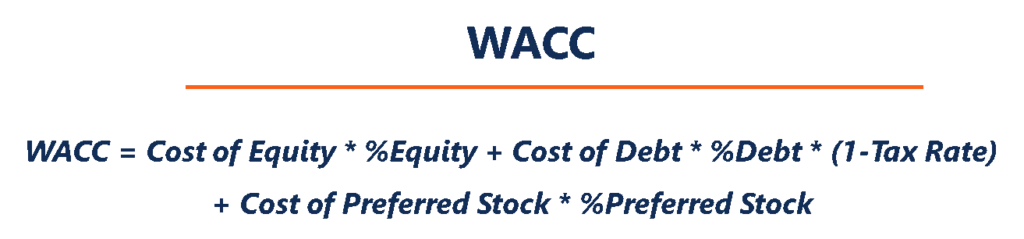

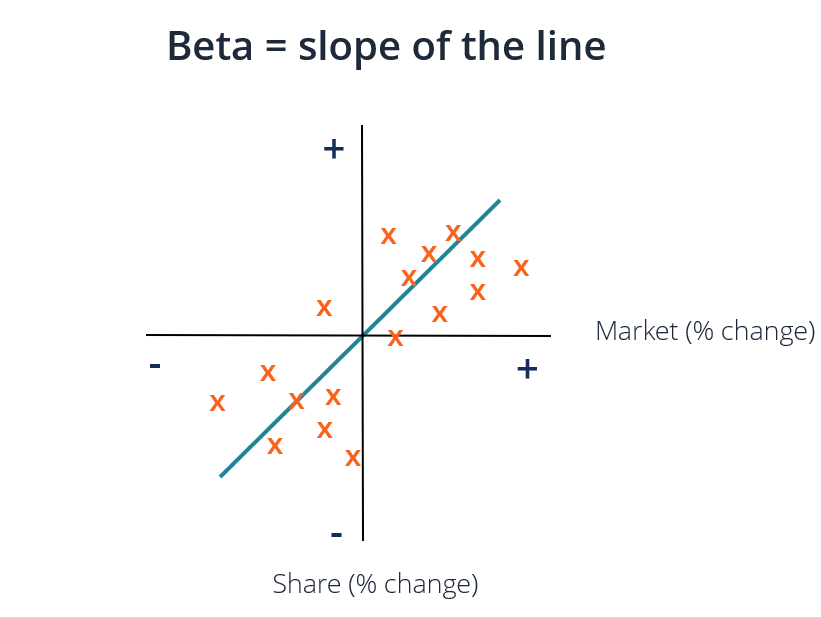

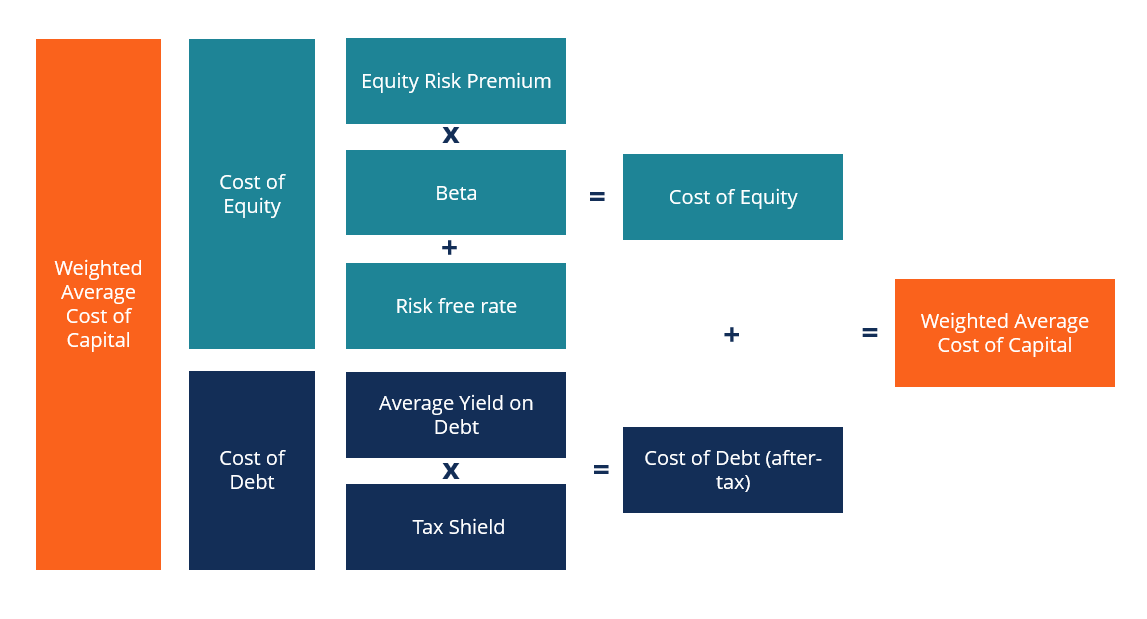

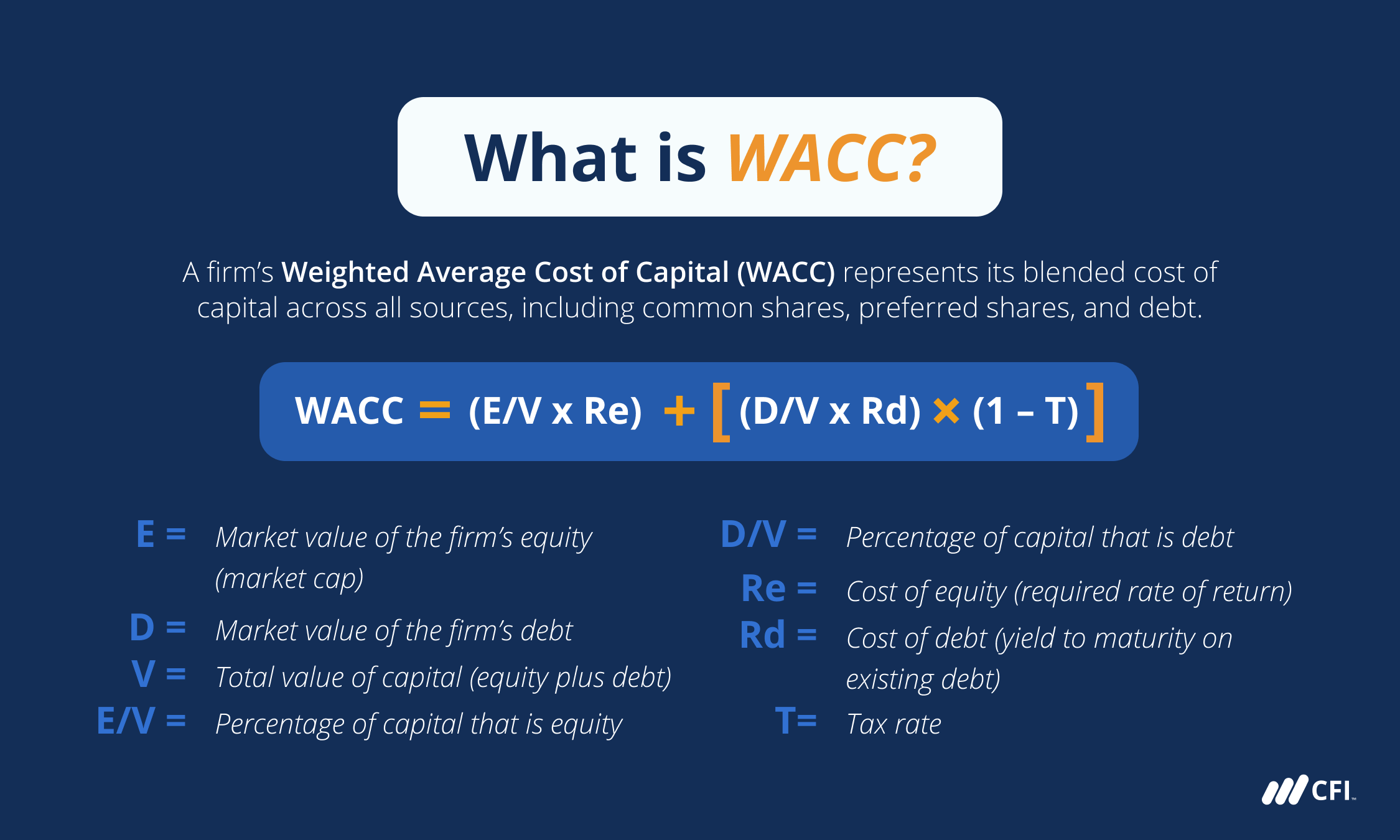

Wacc Formula Definition And Uses Guide To Cost Of Capital

Apv Method Adjusted Present Value Analysis Sell Side Handbook

What Is A Tax Shield Depreciation Tax Shield Youtube

Kirkland Signature Omega Infant Formula 1 36 Kg Costco

What Is A Tax Shield Depreciation Tax Shield Youtube

Wacc Formula Definition And Uses Guide To Cost Of Capital

What Is A Tax Shield Depreciation Tax Shield Youtube

Chapter 4 Sea Level Rise And Implications For Low Lying Islands Coasts And Communities Special Report On The Ocean And Cryosphere In A Changing Climate

Wacc Formula Definition And Uses Guide To Cost Of Capital

11 Essential Financial Analyst Interview Questions And Answers Toptal

Wacc Formula Definition And Uses Guide To Cost Of Capital

Wacc Formula Definition And Uses Guide To Cost Of Capital

What Is Gross Up Tax Gross Up Formula Definition Caprelo

What Is A Tax Shield Depreciation Tax Shield Youtube